tax identity theft description quizlet

Information for Individuals Taxpayer Guide to Identity Theft. This is done so that the thief can claim the victims tax return for themselves.

It Is Easy Today To Obtain A Store Credit Card That You Forget Everything About In 3 Years But T Credit Repair Business Credit Repair Services Improve Credit

Tax Identity Theft This can delay your ability to access legitimate tax refunds causing frustration and loss of funds.

. Identity theft is the crime of obtaining the personal or financial information of another person to use their identity to commit fraud such as. Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work. How To Protect Yourself from Tax Identity Theft Taking steps to protect your personal information can help you avoid tax identity theft.

The fraudulent refund can be. Estimates are that this form of fraud costs consumers 52 billion each year. Identity Theft Central Tax-related identity theft happens when someone steals your personal information to commit tax fraud.

Tax identity theft is a large-scale problem in the United States due to an increase in cyber attacks on employers insurers payroll service providers universities and retailers. To file a return to get your refund. Data Breach An incident in which sensitive protected or confidential records have potentially been viewed stolen or.

Tax info bank or credit card statements or pre approved credit card offers. You find out about it when you try to file a return. Tax identity theft whether its with the Internal Revenue Service or your state s Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolveThe IRS in partnership with the state tax administrations and the software companies that produce at-home filing software has announced several changes.

This is the most common type of tax identity theft. Stealing taking money credit card numbers personal Information from a purse or wallet records at work or school tax records bank or credit card statements Diverting Mail. Tax ID theft was the biggest form of ID fraud reported to the Federal Trade Commission in 2014.

A tax ID fraudster often part of a ring of scammers will file dozens or even hundreds of phony returns with other consumers personal. All identity theft is a crime under California law but criminal identity theft refers to one type of the crime. The Equifax security breach alone exposed 143 million consumers with complete data on Social Security numbers names addresses birth dates and in some cases drivers license numbers.

The act of digging through trash receptacles to find information that can be useful in an attack. If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you must file a paper return. You just studied 28 terms.

Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one of two reasons. Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. English 3 Labo 3 Quadri 2.

Identiy theft wrongfully acquiring and using someones personal identification credit or account information. Software that is specifically designed to detect viruses and protect a computer and files from harm. Pulling the goalie pregnant.

A form of identity theft in which someone steals the identity and sometimes even the role within society of a recently deceased individual. Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return. How to clean piano keys ivory.

For example the thief may use the original holders name and SSN to obtain credit cards credit lines and utility accounts. Identity theft is when a thief gains access to your personal information identity fraud describes a crime in which a thief creates a fictitious person impacts of identity theft include -hurting job prospects -increasing insurance rates -affect social security income credits -slow down tax refund -leave you with a criminal record. Start studying Identity Theft Test.

Criminal identity theft occurs when someone cited or arrested for a crime uses another persons name and identifying information resulting in a criminal record being created in that persons. Learn vocabulary terms and more with flashcards games and other study tools. What is bank deposit payment method.

What is criminal identity theft. People often discover tax identity theft when they file their tax returns. The phrase criminal identity theft may be misleading.

Your taxes can be affected if your Social Security number is used to file a fraudulent return or to claim a refund or credit. FTC A government agency that promotes consumer protection. ID theft through a tax professional.

What Is Tax Identity Theft. Criminals send these claims to the Internal Revenue Service IRS using stolen personal details such as your social security number SSN and name. While using his credit card to buy drinks for a bar full of patrons Diana tangles with the bartender and ends up getting arrested giving Sandys name as her own.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund. In the movie Identity Thief Melissa McCarthy plays Diana a woman who steals the identity of a man named Sandy played by Jason Bateman. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund Basically its identity theft plus tax fraud.

The scam works like this. What to Do if You Think Your Identity Has Been Stolen. When the real Sandy tries to use his.

Though tax identity theft usually refers to a thief filing a fraudulent tax return this type of fraud can include identity fraudsters using someone elses SSN to assume the original holders identity for any reason. Omega speedmaster automatic 1997. This happens if someone uses your Social Security number for employment or they used the information from your W-2 to file income tax returns on your behalf and take your tax refund.

This Identity Theft shows itself through fraudulent tax refund claims. More from HR Block.

Cpa Resume Example Template Iconic Event Management Resume Examples Manager Resume

Ethics Responsibilities In Tax Practice Flashcards Quizlet

Pin On What It Takes To Be An Accountant

Ethics Responsibilities In Tax Practice Flashcards Quizlet

What Is Alternative Minimum Tax H R Block

Identity Theft Flashcards Quizlet

/GettyImages-CA21828-c81e41596d3d4a0b92d330c6494315a6.jpg)

Taxation Without Representation Definition

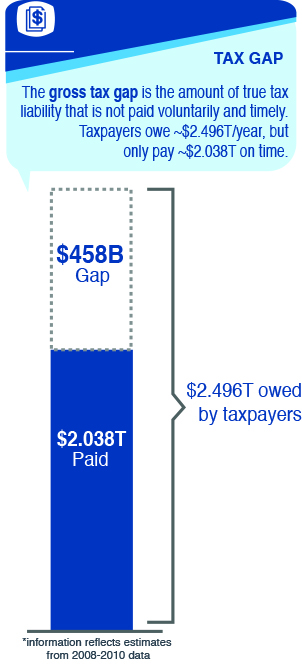

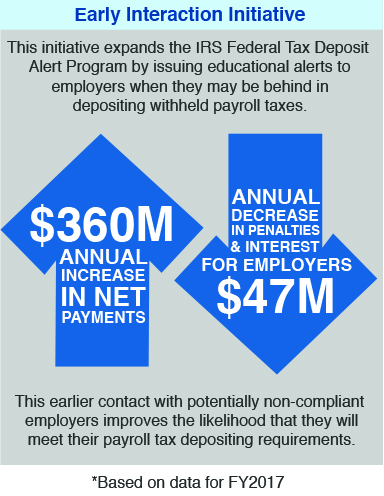

Protect The Tax System Internal Revenue Service

Penalty For Filing A Frivolous Tax Return Community Tax

Tax Return Identity Theft Accounting Humor Identity Identity Theft

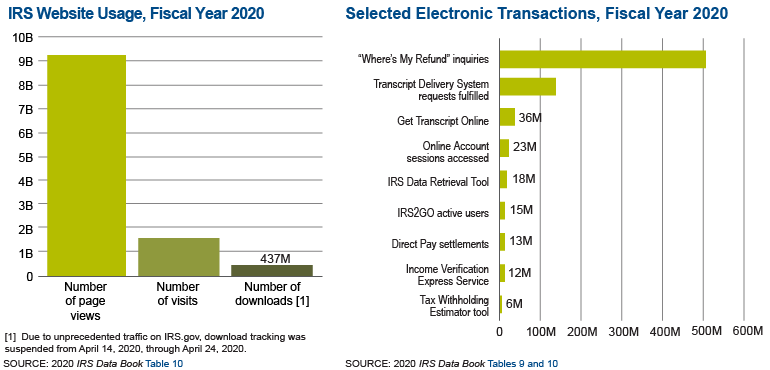

Service To Taxpayers Internal Revenue Service

How The Tcja Tax Law Affects Your Personal Finances

Learn More About A Tax Deduction Vs Tax Credit H R Block

Protect The Tax System Internal Revenue Service

Ethics Responsibilities In Tax Practice Flashcards Quizlet

Ethics Responsibilities In Tax Practice Flashcards Quizlet

Asurion Affidavit Pdf Identity Theft How To Apply Number Forms